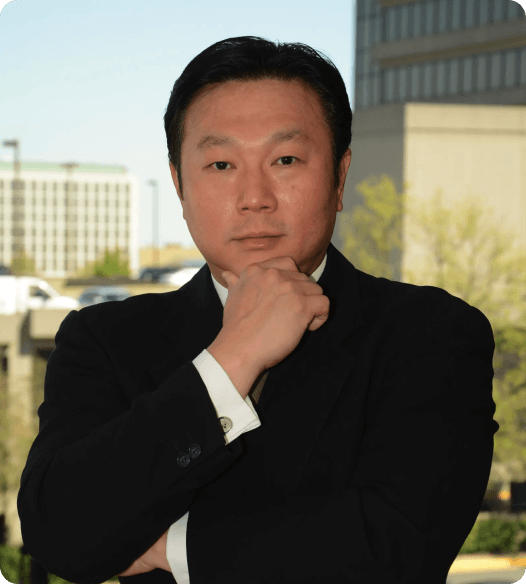

About the coach

Joon Park

Joon Park - Joon has worked for over a decade in test prep, admissions counseling and career mentorship for high school, university, and graduate school students. He holds an MBA from Columbia University, a B.S.E. in Finance from the Wharton School, and a B.A. in Economics with a Philosophy minor from the College of Arts and Sciences at the University of Pennsylvania. Besides education consulting, he has more than 30 years of experience in Finance and Risk Management at global corporations in New York, Los Angeles, Houston, and China.

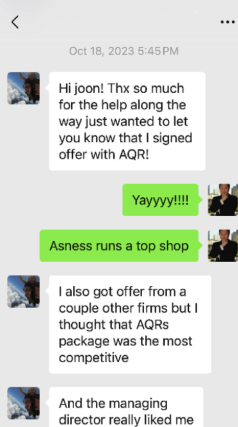

- 30+ years of experience in finance, trading, and business development.

- Run Friends & Family platform for ~10 clients in trading and risk management

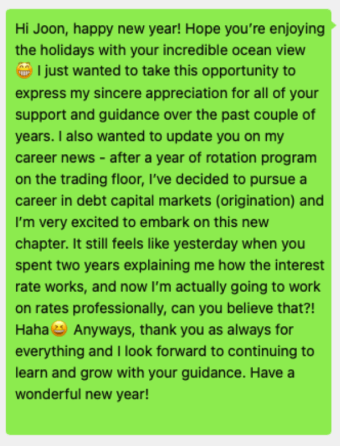

- Previously responsible for establishing a securitization platform for the $35B annual whole-loan mortgage origination business for G.E. Capital, where he developed hedge strategy and authored the hedging policy for the mortgage origination business. He also engineered the interest rate hedging model, framework and processes

- Prior to G.E. Capital, launched energy/power trading operations for R.D. Shell, and developed the energy derivatives business, implementing rigorous and process-driven trading strategies. Created and expanded the power derivatives trading desk allowing Shell to monetize power assets, and managed the risk systems as well as providing hedging strategies for institutional clients such as utilities and power generation companies. He brought best practices from his previous Wall Street experience to the newly deregulating and developing energy industry in the U.S. Pioneering the use of relative value trading strategies in this new market, he unlocked value in the spark-spread between natural gas and power and monetized optionality in natural gas storage units and co-gen plants. Leading proprietary market-maker for power derivatives in the Midwest, East Coast (PJM & NY Hub), and Texas power grids.

- Started Wall Street career in portfolio strategy and risk management. Responsible for fixed income relative-value trade structuring and portfolio management and hedging strategies for institutional clients at Credit Suisse First Boston. Subsequently became AVP for the newly established Independent Risk Management unit at the Bank of Tokyo Mitsubishi, largest bank in the world at the time, conducting risk analysis and developing risk management policies and procedures.

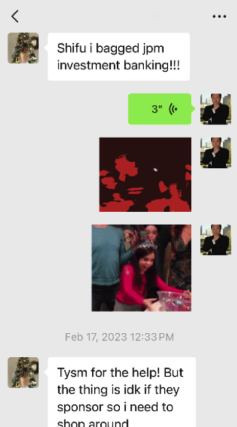

- M.B.A. in Finance with Honors from Columbia University. Sales and trading associate for J.P. Morgan. B.S.E./B.A. from Wharton School & College of Arts and Sciences at University of Pennsylvania where he served as a Zweig Fellow.